Explore the world of AI options trading. This guide explains how AI works, its benefits, risks, and how to get started with data-driven trading strategies.

When you hear "AI options trading," your mind might jump to sci-fi movies filled with self-aware computers making billions overnight. The reality is a bit more grounded, but no less impactful. At its heart, AI options trading is simply about using intelligent software to analyze market data, spot potential price moves, and execute trades—often with little to no direct human input.

This technology is changing the game by applying machine learning and predictive analytics to find opportunities that a human trader, no matter how experienced, would likely miss. It's about making faster, smarter, and more data-driven decisions in a market that never sleeps.

Demystifying AI in the Options Market

Let's be clear: AI options trading isn't some futuristic fantasy. It's a practical tool that’s already reshaping how everyone from individual retail traders to massive financial institutions approaches the market. Think of it as giving yourself a hyper-intelligent assistant who can process staggering amounts of information with inhuman speed and precision.

Here's a simple analogy. A traditional trader is like a seasoned detective, manually poring over charts, reports, and news clippings to piece together a case. An AI-powered trader, on the other hand, is like that same detective armed with a supercomputer running facial recognition, sentiment analysis on social media, and satellite tracking all at once. The AI doesn’t just look at historical price charts; it scans news headlines, deciphers institutional order flows, and cross-references thousands of other data points in real time to find an edge.

The Core Function of AI in Trading

The real goal here isn't just basic automation. Old-school trading bots were built on rigid "if this, then that" rules, which fall apart the moment market conditions change. AI systems are different. They're designed to learn and adapt. They sift through the endless noise of the market to find meaningful patterns, helping traders make much more informed decisions.

Over the next few sections, we'll unpack exactly how these systems work and what they mean for you. We’ll cover:

- The underlying mechanisms that actually power these AI trading tools.

- The tangible benefits like speed, efficiency, and emotion-free execution.

- The inherent risks and critical limitations you need to be aware of.

- A practical roadmap to help you get started with AI-driven strategies.

By leaning on AI, traders can analyze millions of data points in seconds—a task that would take a human analyst weeks to complete. This isn't just about being faster; it's about uncovering subtle connections and predictive signals that lead to smarter trading.

This fundamental shift from manual grunt work to intelligent, data-driven assistance is what AI options trading is all about.

How AI Is Revolutionizing Options Analysis

To really get what AI options trading brings to the table, you have to look past simple automation. Think of old-school trading bots like a basic calculator—they just follow simple "if-then" rules you give them. AI is a whole different beast. It’s more like a seasoned detective, piecing together clues that don't seem connected to solve the bigger mystery.

This difference is crystal clear in how AI analyzes options. It's not just looking at price and volume. AI systems are built to consume millions of data points from just about everywhere: institutional order books, dark pool prints, news headlines, and even social media chatter. They're constantly digging for the subtle footprints that show up right before a big market move.

Uncovering Hidden Market Signals

The real magic of AI is its knack for spotting anomalies. These are the unusual blips of activity that often give away what the institutional players, or "smart money," are up to. For example, an AI might flag a sudden, massive buy of out-of-the-money call options on a particular stock, even when the news around the company is totally flat.

A human analyst might just write that off as noise. But the AI can instantly cross-reference that single event with thousands of historical examples. It might recognize that exact pattern has preceded a significant upward price move 78% of the time. It connects dots that are practically invisible to us.

AI's core job isn't just to see the market as it is right now, but to understand the forces pushing it around. It finds the faint tracks left by big money, giving traders a predictive edge that rule-based systems just can't offer.

The Power of Predictive Modeling

At the heart of all this is machine learning, a branch of AI where algorithms are trained on gigantic sets of historical data. Picture it like teaching a rookie trader by making them study every single winning trade from the last ten years. The AI learns what works, what doesn't, and which subtle conditions lead to specific outcomes.

This is what fuels AI-driven option flow bots. They crunch millions of data points in real-time to spot faint trading patterns and market shifts way faster than any human possibly could. These bots mix institutional-grade options flow data with machine learning models that are always learning from market history, getting sharper over time. You can see how these AI bots work on platforms like ai-signals.com.

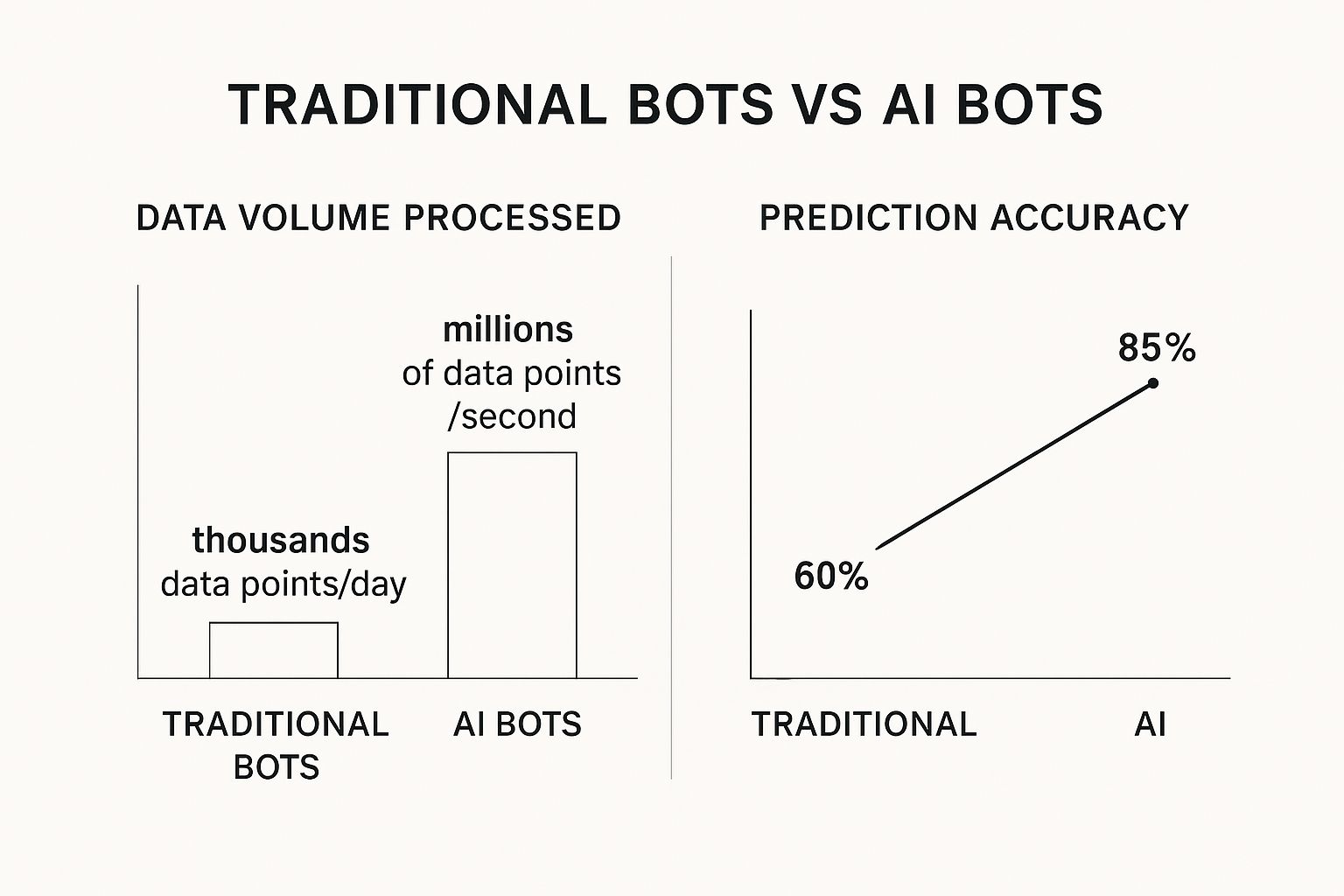

This infographic shows just how different AI bots are from traditional automated systems in both processing power and accuracy.

As you can see, the AI’s ability to process millions of data points every second is directly tied to its massive jump in predictive accuracy.

Learning and Adapting in Real Time

And here's the crucial part: the learning never stops. A static strategy gets old fast, but AI models are constantly updating themselves based on new market information. This is absolutely vital in options trading, where the entire game can change in a heartbeat. The main advantages here are:

- Adaptability: The AI adjusts its models when new market dynamics pop up, so its strategies don't go stale.

- Speed: It can analyze complex data and act on it in milliseconds, catching those blink-and-you'll-miss-it opportunities.

- Objectivity: Every single decision is based on cold, hard statistics. This completely removes emotional biases like fear and greed from the trading process.

By blending deep data analysis with a brain that's always learning, AI options trading gives traders a much more dynamic and insightful way to handle today's complex markets.

AI Bots vs. Traditional Trading Bots: What's the Real Difference?

Most traders have heard of automated trading, but the jump from old-school bots to modern AI systems is a massive leap forward. It’s less of an upgrade and more of a complete reinvention. Think of it like comparing a simple pocket calculator to a supercomputer—both can crunch numbers, but their intelligence and what they can actually do in the market are worlds apart.

A traditional trading bot is rigid. It’s built to follow a strict, pre-programmed set of rules without any deviation.

Imagine a loyal soldier who only follows direct orders. You could program a bot with a rule like, "If the RSI drops below 30 and the price crosses the 50-day moving average, buy a call option." The bot will execute that command perfectly every single time those exact conditions line up. But it can't think for itself, and it has zero ability to adapt if the market context changes.

The Problem with Rule-Based Bots

These classic bots are entirely dependent on the rules you give them. They operate within a fixed "if-this-happens, then-do-that" framework and can't learn from mistakes or successes. More importantly, they'll never spot a new opportunity unless it fits perfectly into the narrow parameters you've already defined.

This inflexibility is their biggest weakness in today's fast-moving markets. If the market starts behaving in a way you didn't anticipate, the bot will just keep following its old rules, which could easily lead to a string of losses. Their performance is only ever as good as the rules they’re given, which means they need constant babysitting and manual tweaks to stay relevant.

The Adaptive Power of AI Bots

This is where AI options trading bots change the game. They are dynamic, built from the ground up to learn and evolve. Instead of just executing a static script, they use complex algorithms like neural networks to analyze massive amounts of data and recognize subtle, shifting patterns that a human—or a simple bot—would miss.

An AI bot doesn’t just see that the RSI is below 30. It analyzes why it might be there by connecting that signal with news headlines, social media sentiment, institutional trading volume, and dozens of other factors happening at the same time.

Here’s the core difference: a traditional bot executes the strategy you give it. An AI bot helps you discover, test, and refine the best strategy in real-time. It’s a shift from a simple execution tool to an intelligent trading partner.

These AI bots use learning-based predictive models that adapt on the fly. By leveraging deep neural networks and reinforcement learning, they can interpret complex signals like implied volatility spikes or sudden shifts in market mood, continuously optimizing their approach without needing you to step in. For a deeper dive into how these advanced bots are developed, check out this guide from biz4group.com.

To make it even clearer, let's break down the key differences side-by-side.

AI Trading Bots vs Traditional Rule-Based Bots

This table highlights the fundamental divide between older automation and true AI intelligence.

| Feature | Traditional Rule-Based Bot | AI-Powered Trading Bot |

|---|---|---|

| Decision-Making | Follows strict "if-then" rules | Uses predictive models and pattern recognition |

| Adaptability | Static; requires manual updates | Dynamic; learns and adapts to new data in real time |

| Data Analysis | Limited to specific indicators (e.g., RSI, MACD) | Processes vast, unstructured data (news, sentiment) |

| Strategy | Executes a fixed, pre-programmed strategy | Optimizes and evolves strategies autonomously |

| Human Input | Requires constant monitoring and adjustments | Aims for reduced human intervention over time |

In the end, while traditional bots were a great first step in bringing automation to trading, AI is what introduces actual intelligence. This evolution from blind execution to adaptive analysis is what makes AI options trading such a powerful tool for today's traders.

What Are the Real Benefits of Bringing AI into Your Trading Strategy?

Let's be clear: integrating AI into your options trading isn't about chasing the latest tech trend. It’s about securing a real, measurable advantage in a market that doesn't wait for anyone. The main perks come from AI's ability to process information and act at a scale no human possibly could, turning a firehose of market data into clear, actionable signals.

The first thing you'll notice is the incredible speed and efficiency. The options market operates in milliseconds. An opportunity can appear and vanish in the time it takes you to move your mouse and click. An AI algorithm, on the other hand, can spot a setup, confirm the conditions, and execute a trade in a literal fraction of a second. This means you stop missing out simply because you weren't fast enough.

This kind of speed is no longer a luxury; it's a necessity. The U.S. options market is exploding—as of January 2025, it shattered records with over 1.2 billion contracts traded in a single month. That kind of volume, driven by everyone from big institutions to everyday retail traders, creates an unbelievable amount of data noise. Only an AI can cut through it effectively. You can learn more about this historic growth in options trading on speedbot.tech.

Take Emotion Out of the Equation

This might just be the most powerful benefit of all. Even the most disciplined human trader is still human. We all fight against fear, greed, and the dangerous temptation of "hope." These emotions are the primary culprits behind bad decisions, like clinging to a losing trade for too long or jumping out of a winning one too early.

An ai options trading model doesn't have these problems. It runs on pure data, cold logic, and statistical probabilities. It doesn't get scared during a market dip or overconfident after a few wins. It just follows the strategy, day in and day out, protecting your capital and ensuring you stick to the plan.

AI acts as the ultimate disciplined trader. By systematically executing trades based on a data-validated strategy, it removes the single biggest point of failure for most traders: emotional interference.

Better Risk Management and Smarter Decisions

Think about trying to juggle a dozen open positions at once, all while keeping an eye on shifting market news and volatility. It's impossible for a person to do it well. But an AI system can monitor everything simultaneously, without breaking a sweat. If a position starts to turn against you or volatility spikes unexpectedly, the AI can instantly adjust a stop-loss or hedge the trade based on the rules you've set.

This constant, tireless vigilance leads to much smarter, data-driven decisions. Instead of going with a gut feeling or a half-baked analysis, every single trade is backed by a complete evaluation of the available market data. This systematic approach is built on three core strengths:

- Pattern Recognition: AI is brilliant at finding subtle, recurring market patterns that often come before a significant price move.

- Predictive Analysis: It uses huge amounts of historical data to calculate the probability of a trade setup working out in your favor.

- Real-Time Adaptation: As new information hits the market, the AI can adjust its approach on the fly.

When you combine this kind of speed, objectivity, and intelligent risk control, you empower yourself to navigate today's complex markets with far more confidence and precision.

Of course, here is the rewritten section, crafted to sound completely human-written and natural, following the provided style guide and examples.

Navigating the Risks and Limitations of AI Trading

While AI options trading opens the door to some powerful strategies, you have to go in with your eyes open. No system is a magic bullet, and AI is certainly no exception. The first step to building a solid trading approach is understanding where the pitfalls are, so you can use technology without becoming a slave to it.

One of the biggest traps is a problem called overfitting. This is what happens when an AI model gets so good at analyzing past data that it basically just memorizes it. It fails to learn the underlying patterns needed to adapt to new market conditions.

Think of it like a student who crams for a test by memorizing the exact answers from last year's exam. They might ace a practice run on the old questions, but they'll be totally lost when the real test throws them a curveball. The AI might look brilliant in backtesting, only to fall apart in a live market.

The Black Box Problem

Another huge hurdle is the "black box" nature of many sophisticated AI models. Complex neural networks can spit out a trading decision, but good luck trying to figure out how they got there. The AI might signal a high-probability trade, but it can't sit you down and explain the why in plain English.

This lack of transparency becomes a massive problem when the AI starts losing. If you can't understand its reasoning, diagnosing the root cause is next to impossible. You're left guessing.

Trusting a system you don't understand is a recipe for disaster. Smart AI trading isn't about blind faith; it's about using a tool where you understand its logic and, more importantly, its limits.

Finally, don't ever forget about simple technical failures. The smartest AI on the planet is useless if the system supporting it goes down. These operational risks can wipe you out if you're not prepared.

- Connectivity Issues: Losing your internet connection for a few seconds at the wrong time can mean a missed entry or a winning trade that turns into a loser.

- Data Feed Errors: The AI is only as good as the data it's fed. A glitchy or delayed data feed can lead to terrible decisions based on bad information.

- Software Bugs: All complex software has bugs. An unexpected glitch could cause your AI to stop trading, place wrong orders, or worse.

The best way to handle these risks is to always keep a human in the loop. Start with capital you can afford to lose, and test everything relentlessly in a demo account before risking a single real dollar. This balanced approach lets you tap into the power of AI options trading while keeping you safe from its built-in weaknesses.

Practical Steps to Get Started with AI Options Trading

Jumping into ai options trading can feel overwhelming, but a simple, structured plan makes it far more approachable. The very first move, before you even look at a single platform, is education.

You need a solid foundation in two areas: the fundamentals of options trading and the basic concepts behind AI. You don’t need a data science degree, but you absolutely have to understand what machine learning is actually doing to make its predictions.

Once you’re comfortable with the basics, it’s time to explore the tools out there. The market is full of options, from simple signal services for beginners to sophisticated platforms that integrate directly with your brokerage account. Each one is built for a different kind of trader, so finding your perfect fit is critical.

Choosing the Right AI Trading Platform

When you’re comparing tools, don't let the price tag be your only guide. Your final decision should hinge on a few key factors that prove a platform is not just effective, but also trustworthy.

- Transparency: How does the AI arrive at its conclusions? The best platforms give you at least some insight into their models and methodology. You shouldn't be following signals blindly.

- Backtesting Features: A quality tool will let you see exactly how its strategies would have performed on historical market data. This is non-negotiable for building confidence in its predictive models.

- User Reviews: Dig into genuine feedback from other traders. Platforms like Tickeron and Trade Ideas have very different strengths, and real user experiences will tell you which one aligns with your trading style.

The goal isn't just to find any AI tool; it's to find the right tool for your specific strategy and risk tolerance. A careful, phased approach is the only safe way to bring AI into your trading routine.

A Phased Implementation Plan

Finally, we get to the most important part: putting your chosen tool to work without blowing up your account. Going all-in with real money from day one is a recipe for disaster. Instead, follow a disciplined, two-stage process.

- Start with Paper Trading: Use a demo account to test the AI’s signals and strategies without risking a single dollar. Think of this as your training ground. It's where you learn the platform’s quirks and see how its calls perform in live market conditions.

- Move to Small, Controlled Live Trades: Once you’ve seen consistent positive results in your paper account, you can start trading with a very small amount of real capital. The goal here isn't to get rich; it's to get comfortable with the psychological pressure of having actual money on the line.

This structured entry path for ai options trading keeps your risk to a minimum while you methodically build both experience and confidence.

Common Questions About AI Options Trading

Jumping into the world of AI options trading naturally brings up a few questions. Let's tackle the most common ones to give you a clear picture of what's involved, what you can realistically expect, and how to get started on the right foot.

Do I Need to Be a Programmer to Use AI for Options Trading?

Not anymore. A few years ago, the answer would have been a definite "yes," but that's all changed. While knowing how to code lets you build a custom trading model from the ground up, it’s far from a requirement today.

A whole new generation of user-friendly platforms has emerged, offering everything from sophisticated AI trade signals to fully automated bots. These tools are built specifically for traders, not programmers. They handle the heavy lifting—the complex math and data analysis—behind an intuitive interface. Your job shifts from writing code to developing a strategy: picking a solid platform, understanding its logic, and knowing how to interpret its signals before you put any real money on the line.

Can AI Trading Bots Guarantee Profits?

No, and it's essential to be crystal clear about this. There is no such thing as a guaranteed profit in financial markets, period. Whether the decisions are made by a seasoned human trader or a powerful algorithm, nothing can predict the future with 100% certainty. Markets are just too complex and can be swayed by countless unpredictable events.

What AI does give you is a massive analytical advantage. It can sift through mountains of data and spot statistical patterns that are simply invisible to the human eye. But even the smartest AI can be blindsided by a sudden "black swan" event, a sharp spike in volatility, or the inherent limitations of its own programming. Always, always pair AI options trading with a strict risk management plan.

AI is a powerful tool for improving probabilities and removing emotional bias, but it is not a crystal ball. Success depends on using it to gain an edge, not expecting it to predict the future with perfect accuracy.

How Much Capital Do I Need to Start?

This really depends on how you plan to use AI. You can get your feet wet by subscribing to an AI-driven signal service with a fairly small trading account, sometimes just a few hundred dollars. This is a great way to learn without taking on huge risk.

However, if you're looking to run fully automated strategies, you'll need a bit more runway. You have to account for the platform or software fees, the cost of the options contracts themselves, and—most importantly—enough capital to absorb a few losing trades without blowing up your account. A good rule of thumb is to start with an amount you are completely comfortable losing as you test, tweak, and perfect your system.

At BinaryOptionsGuide, we provide the educational resources and unbiased broker comparisons you need to start your trading journey on the right foot. Explore our expert reviews and guides to find the perfect platform for your strategy at https://binaryoptionsguide.com.

Ready to Start Trading?

Choose from our top-rated binary options brokers and start your trading journey today.

Start Trading Now →