Discover 8 actionable day trading tips for binary options. Master risk management, strategy, and psychology to elevate your trading results in 2025.

Day trading binary options offers a high-stakes, fast-paced environment where quick decisions can lead to significant gains or losses. Success is not about luck; it is about a disciplined, strategic approach. While many seek a single secret strategy, seasoned traders understand that profitability comes from a combination of robust risk management, psychological fortitude, and a deep understanding of market mechanics.

This guide provides a blueprint with 8 essential day trading tips specifically tailored for the unique demands of binary options. Whether you are new to the market or looking to refine your edge, these actionable insights are designed to help you build a professional framework. Our focus is on avoiding common pitfalls and navigating the markets with greater confidence.

You will learn to master everything from crafting a solid trading plan and managing risk to leveraging technical analysis and controlling your emotions. For platform-specific guidance, resources like BinaryOptionsGuide offer detailed reviews of regulated brokers like Nadex and IQ Option, which are crucial for implementing these strategies effectively. By mastering these core principles, you can develop the skills needed for consistent performance. This article moves beyond generic advice to provide the practical steps necessary for building a sustainable trading career.

1. Develop and Stick to a Solid Trading Plan

A trading plan is your personal business plan for navigating the markets. It’s a meticulously crafted document outlining your strategy, risk management rules, and financial objectives. This plan acts as a critical decision-making framework, removing emotion and improvisation from your trading activities, which is one of the most essential day trading tips for achieving consistency.

This document dictates every move you make, from which binary options contracts to trade and at what times, to the exact technical or fundamental signals that trigger an entry or exit. As trading psychologist Dr. Brett Steenbarger emphasizes, professional traders don't just "wing it"; they operate from a well-defined and tested playbook. For example, proprietary trading firms often require their traders to submit and adhere to a detailed plan before allocating capital, proving its importance at the highest levels.

How to Implement a Trading Plan

Creating and following a plan is a non-negotiable step for serious traders. It provides the structure needed to trade with discipline, especially in the fast-paced world of binary options.

- Define Your Rules: Document your entry and exit criteria with absolute clarity. For instance, you might enter a "Call" option on EUR/USD only when the Relative Strength Index (RSI) crosses below 30 on the 5-minute chart and a bullish engulfing candle forms.

- Set Strict Risk Parameters: Your plan must specify the maximum percentage of your capital you'll risk on a single trade. A common rule is to never risk more than 1-2% of your total account balance.

- Backtest and Refine: Use a demo account or historical data to test your strategy's effectiveness. This "paper trading" phase helps you validate your plan and make adjustments without financial loss.

- Keep a Journal: A trading journal is the companion to your plan. It’s where you log every trade, noting the setup, outcome, and your emotional state. This practice holds you accountable and provides data for future plan revisions.

By externalizing your decision-making process into a written document, you build a barrier against impulsive actions driven by fear or greed, ensuring your trading is systematic and objective.

2. Master Risk Management and Position Sizing

Effective risk management is the bedrock of a sustainable trading career; it’s the practice of protecting your capital from catastrophic loss. This principle is more important than any entry signal or strategy. It involves defining how much you are willing to lose on a single trade, which is a crucial day trading tips cornerstone that separates professionals from amateurs.

The core idea is to never risk more than a small, predetermined percentage of your total account balance on any one trade, typically 1-2%. This ensures that a string of inevitable losses won't wipe you out. As trading coach Van K. Tharp teaches, your "position sizing" model dictates how you achieve your objectives. In contrast, the infamous case of Nick Leeson collapsing Barings Bank serves as a stark reminder of what happens when risk management is ignored entirely.

How to Implement Risk Management

Proper risk management isn't just a defensive measure; it’s an offensive tool that keeps you in the game long enough for your strategy's edge to play out. It transforms trading from a gamble into a calculated business.

- Calculate Your Position Size: Before entering a trade, determine your position size. A simple formula is: (Account Size × Risk %) ÷ (Entry Price - Stop Loss Price). This calculation aligns every trade with your risk tolerance.

- Set a Daily Loss Limit: Establish a maximum amount you can lose in a single day, such as 3-5% of your account. If you hit this limit, you must stop trading immediately. This prevents "revenge trading" and emotional decision-making.

- Respect Your Stop-Loss: A stop-loss is your non-negotiable exit point for a losing trade. Never move your stop-loss further away from your entry price in the hope that the market will turn around.

- Keep a Risk Checklist: Create a simple checklist to verify before every trade. Does this trade fit your 1% risk rule? Is your stop-loss set? Have you hit your daily loss limit? This builds a consistent, disciplined routine.

By rigorously applying these rules, you control your downside, protect your psychological capital, and give yourself the mathematical foundation needed for long-term profitability in the markets.

3. Focus on Liquid Markets and High-Volume Stocks

Liquidity is the lifeblood of day trading; it determines how easily an asset can be bought or sold at a stable price. Focusing on highly liquid markets and high-volume stocks is one of the most fundamental day trading tips because it ensures you can enter and exit trades efficiently without significant price slippage, which is critical when capitalizing on small price movements.

This principle means targeting assets with substantial trading volume, typically over one million shares daily. High volume creates tight bid-ask spreads, reducing transaction costs and ensuring your orders are filled at the expected prices. Trading experts like Andrew Aziz, in his book "How to Day Trade for a Living," emphasize that consistent profitability is nearly impossible in illiquid markets. Professional firms like SMB Capital build their entire strategies around "in-play" stocks that exhibit massive liquidity, allowing them to scale in and out of large positions seamlessly.

How to Implement a Liquidity-Focused Strategy

Prioritizing liquidity protects you from getting trapped in a trade and minimizes the hidden costs of slippage. It provides the smooth market conditions necessary for short-term strategies to work effectively.

- Screen for High Volume: Use your trading platform's stock screener to filter for stocks with an average daily trading volume of over 1 million shares. This is your primary liquidity check.

- Analyze the Bid-Ask Spread: Before entering a trade, check the spread. In liquid stocks like Apple (AAPL) or ETFs like SPY, the spread is often just a penny. Avoid assets with wide spreads, as they immediately put you at a disadvantage.

- Trade During Peak Hours: The highest liquidity occurs during the first and last hours of the U.S. market session (9:30-10:30 AM and 3:00-4:00 PM EST). Concentrate your trading activity during these windows for the best execution.

- Leverage ETFs for Consistency: Exchange-Traded Funds (ETFs) that track major indices, such as SPY (S&P 500) and QQQ (Nasdaq 100), offer exceptional liquidity and are favored by many professional day traders for their predictable price action and tight spreads.

By sticking to this discipline, you ensure the market has enough participants to absorb your orders instantly, creating a more predictable and less frustrating trading environment.

4. Use Technical Analysis and Chart Patterns

Technical analysis is the art of studying historical price charts and market data to forecast future price movements. For day traders, especially in the fast-paced binary options market, this skill is indispensable. It provides an objective, data-driven framework for identifying trading opportunities, defining entry and exit points, and gauging market sentiment without relying on subjective fundamental analysis. This is one of the most foundational day trading tips for building a repeatable strategy.

This discipline revolves around the idea that all known information is already reflected in the price. Legendary traders have built entire careers on mastering chart patterns. For instance, Steve Nison introduced Japanese candlestick charting to the West, revolutionizing how traders visualize price action, while William O'Neil’s 'cup and handle' pattern has helped countless traders identify major breakouts. These methods provide a visual roadmap of the ongoing battle between buyers and sellers.

How to Implement Technical Analysis

Effectively using technical analysis requires focusing on a few core concepts and applying them with discipline, rather than cluttering your charts with dozens of indicators.

- Master Key Patterns: Start by learning to identify high-probability candlestick patterns like engulfing bars, dojis, and hammers. Also, focus on classic chart patterns such as head and shoulders, triangles, and flags, as they often precede significant price moves.

- Use Indicators for Confirmation: Select 2-3 complementary indicators, like the Relative Strength Index (RSI) for momentum and Moving Averages for trend direction. Use them to confirm what price action is telling you, not as standalone entry signals.

- Analyze Multiple Time Frames: Gain a broader perspective by checking a higher time frame (like the 1-hour chart) to understand the overall trend. Then, use a lower time frame (like the 5-minute chart) to pinpoint precise entry and exit points for your binary options trades.

- Draw Support and Resistance: Manually identify and draw key horizontal levels where price has historically reversed. These zones of supply and demand are critical areas to watch for potential trades or to set as price targets.

By methodically applying these techniques, you can develop an objective edge, enabling you to anticipate market movements and trade with greater confidence and precision.

5. Control Your Emotions and Trading Psychology

Trading psychology refers to the emotional and mental discipline required to make objective, logical decisions in the market. Mastering your mindset to control powerful emotions like fear, greed, and the urge for revenge is often what separates profitable traders from the rest. This is one of the most crucial day trading tips, as a flawless strategy is useless if you abandon it due to emotional impulses.

The market is a psychological battlefield, and your biggest opponent is often yourself. As author and trading coach Mark Douglas explains in his seminal book "Trading in the Zone," the best traders think differently about probabilities and don't let individual outcomes affect their mental state. They focus on flawless execution of their edge over a series of trades, not on the result of any single trade. This mindset prevents emotional spirals that lead to over-trading or deviating from a proven plan.

How to Implement Emotional Discipline

Developing emotional control is an active, ongoing process that requires self-awareness and structured routines. It is the foundation that allows your trading plan and strategy to function effectively.

- Develop a Pre-Market Routine: Prepare your mind for the trading day. This could involve meditation, reviewing your trading plan, or analyzing charts without market pressure. The goal is to start the session calm, focused, and objective.

- Set Firm Stop-Loss Rules: Enforce a hard daily loss limit. If you hit this limit, you must stop trading for the day, no exceptions. This prevents "revenge trading," where you try to win back losses with impulsive, high-risk trades.

- Take Strategic Breaks: Step away from your screen after a series of consecutive losses or even after a significant winning streak. This emotional reset helps you avoid decision fatigue and maintain a neutral perspective.

- Journal Your Emotions: Alongside your trade details, log how you felt before, during, and after each trade. Note instances of fear, greed, or anxiety. This practice builds self-awareness and helps you identify emotional patterns that negatively impact your performance.

By treating trading psychology with the same importance as technical analysis, you build the resilience needed to execute your strategy consistently, regardless of market volatility or short-term outcomes.

6. Start Small and Scale Gradually

One of the most crucial yet overlooked day trading tips is to start your live trading career with minimal capital and small position sizes. This approach acknowledges the steep learning curve inherent in trading and allows you to gain invaluable real-market experience without the risk of devastating financial loss. Many new traders make the mistake of overcapitalizing their initial account, only to see it diminish quickly as they navigate the complexities of live markets.

By starting small, you give yourself the psychological and financial space to make mistakes, which are an inevitable part of the learning process. Legendary investor Paul Tudor Jones famously advised new traders to "play the game with the smallest possible positions." This method shifts your focus from chasing large profits to mastering your strategy and emotional discipline, building a solid foundation for long-term success. Success stories like Tim Grittani, who turned $1,500 into millions, highlight the power of gradual, disciplined scaling.

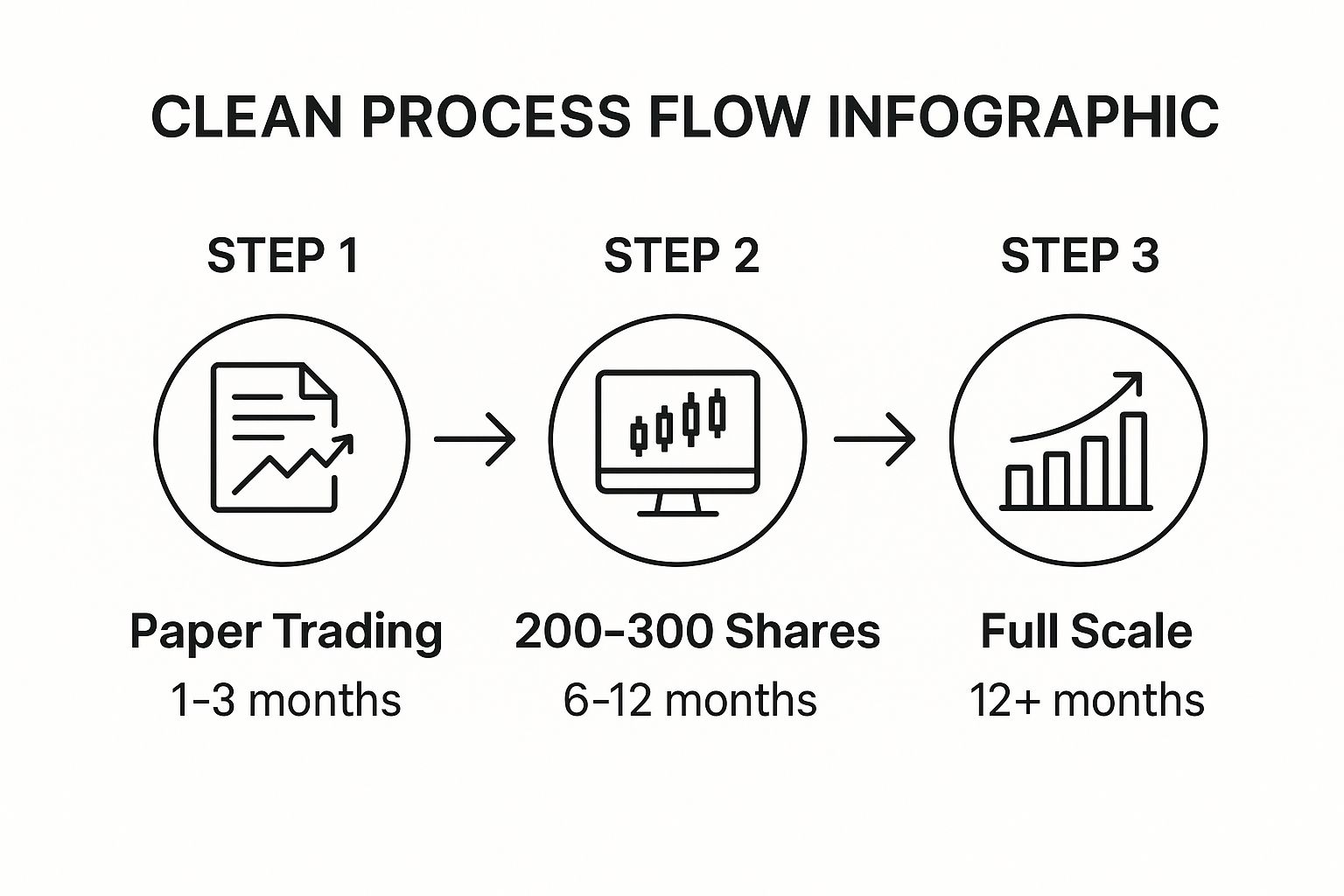

The infographic below illustrates a structured, progressive scaling plan that prioritizes skill development over premature profit-seeking.

This visual roadmap emphasizes a patient, multi-stage approach where each phase builds upon the last, ensuring you only increase risk after demonstrating consistent profitability and competence.

How to Implement a Gradual Scaling Strategy

Adopting a "start small" mentality is a strategic move to preserve capital while you develop the skills required for consistent profitability. It's a business-like approach that prioritizes longevity over short-term gains.

- Begin with Paper Trading: Before risking any real money, spend 1-3 months on a demo account. The goal is to learn your trading platform's mechanics and test your strategy's rules without financial pressure.

- Use Minimal Live Capital: Start your live trading journey with a small, manageable account, ideally between $1,000 and $5,000. This amount is significant enough to feel real but not so large that early losses will be catastrophic.

- Define Your Starter Size: Trade with a minimal, fixed position size, such as 100-200 shares, until you achieve consistent profitability for at least three consecutive months. The focus here is on process, not profits.

- Set Clear Scaling Milestones: Establish objective performance metrics that trigger an increase in size. For example, you might decide to scale up only after achieving a 10% monthly profit for a full quarter.

- Scale Incrementally: Once you meet your milestones, increase your position size modestly, by no more than 25-50%. If your performance declines with the larger size, immediately scale back down to your previous level.

7. Establish a Consistent Daily Trading Routine

Treating trading like a business rather than a hobby requires a structured daily routine. A consistent routine provides the framework for discipline, focus, and methodical execution, which are critical day trading tips for navigating the volatile binary options markets. It transforms reactive, emotional trading into a proactive, professional process.

This regimen isn't just about setting office hours; it's a comprehensive schedule that includes pre-market analysis, focused trading sessions, and post-market review. As detailed by trading coach Mike Bellafiore in his book The Playbook, elite traders at firms like SMB Capital follow rigorous daily routines that cultivate consistency and peak performance. This systematic approach ensures you are prepared, focused, and always learning from your activities, preventing burnout and reinforcing good habits.

How to Implement a Daily Trading Routine

Building and adhering to a daily schedule is essential for creating the mental and environmental conditions necessary for successful trading. It helps manage emotions, reduces impulsive decisions, and ensures you are fully prepared for market open.

- Pre-Market Preparation: Wake up at a consistent time, at least 1-2 hours before the market opens. Spend this time reviewing economic news, scanning charts for potential high-probability setups on your chosen assets, and creating a watchlist for the day.

- Define Your Trading Window: Identify and commit to trading only during your optimal hours. For many, this is the first 1-2 hours after market open (e.g., 9:30-11:30 AM EST) when volume and volatility are highest.

- Execute with Focus: During your trading window, eliminate distractions and focus solely on executing your trading plan. Take short breaks every 60-90 minutes to reset your mental state and maintain sharp focus.

- Post-Market Review: Once your trading window closes, your work isn't done. Dedicate 15-30 minutes to journal your trades, analyze your performance against your plan, and identify lessons learned for the next session.

This disciplined, business-like approach turns chaotic market action into a structured professional endeavor, fostering the consistency needed for long-term profitability.

8. Choose the Right Trading Tools and Technology

Your trading performance is directly linked to the quality of your tools and technology. A professional setup isn't a luxury; it's a necessity for competing in fast-moving markets. This includes a reliable trading platform, real-time data feeds, advanced charting software, and hardware that can keep up. An inadequate setup creates a significant disadvantage, leading to missed opportunities and costly execution errors.

This principle is a core part of the professional trading ethos, as emphasized by proprietary firms like SMB Capital, which equip their traders with institutional-grade technology. Similarly, renowned trader Andrew Aziz details specific broker and platform configurations necessary for high performance. For example, a professional trader might use 4-6 monitors, with dedicated screens for charts, Level 2 data, a real-time news feed, and open positions. This comprehensive view allows for faster analysis and decision-making, which is one of the most critical day trading tips for gaining a competitive edge.

How to Implement the Right Tech Setup

Assembling the right tools is a foundational step. Your technology must provide speed, reliability, and access to critical market information without lag or failure.

- Select a High-Performance Broker: Prioritize brokers known for fast execution speeds and robust platforms, such as Interactive Brokers or TradeStation. Low commissions are important, but execution quality is paramount.

- Invest in Capable Hardware: Start with a minimum of two monitors to track charts and your trading platform simultaneously. Ensure your computer has at least 16GB of RAM, a solid-state drive (SSD), and a modern processor to handle data-intensive software.

- Utilize Essential Software: Subscribe to a real-time Level 2 data feed to see order flow and use a powerful stock scanner like Trade-Ideas to find high-volume opportunities. Platforms like Thinkorswim offer comprehensive integrated tools.

- Optimize Your Workflow: Configure hotkeys for instant order execution (buy, sell, cancel). Have a backup internet connection, like a mobile hotspot, ready to prevent costly disconnections. Test all platform features in a demo account before trading with real capital.

By investing in the proper technology, you equip yourself with the tools necessary to analyze the market accurately and execute your strategy with the speed and precision required for success.

Day Trading Tips: Key Strategy Comparison

| Strategy/Focus | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Develop and Stick to a Solid Trading Plan | Medium - requires detailed planning and updates | Time investment for creation and review | Consistent, disciplined trading with reduced impulsivity | Traders seeking structure and emotional discipline | Removes emotion, maintains consistency, enables objective evaluation |

| Master Risk Management and Position Sizing | Medium - requires ongoing calculations and adjustments | Requires mathematical skills and constant monitoring | Capital preservation, survival through losses, long-term profitability | All traders needing to protect capital and manage risk | Limits losses, reduces stress, improves edge mathematically |

| Focus on Liquid Markets and High-Volume Stocks | Low to medium - simple screening and monitoring | Access to high-volume stocks and real-time data | Faster execution, lower slippage, reliable price discovery | Day traders needing quick entry/exit and low costs | Tight spreads, quick orders, better technical reliability |

| Use Technical Analysis and Chart Patterns | Medium to high - requires study and practice | Charting software and learning time | Objective trade signals, risk management, quick decision-making | Traders relying on price patterns and indicators | Clear entry/exit signals, works across markets, backtestable |

| Control Your Emotions and Trading Psychology | High - ongoing mental discipline and self-awareness | Time and possible coaching or therapy | Improved decision-making, consistency, fewer costly errors | Traders struggling with emotional trading | Prevents impulsivity, reduces stress, supports plan adherence |

| Start Small and Scale Gradually | Low - scalable approach with clear phases | Small initial capital, patience, tracking | Limits losses during learning, builds confidence and skills | Beginners and those refining strategies | Reduces risk, builds experience, improves emotional control |

| Establish a Consistent Daily Trading Routine | Medium - requires commitment and time management | Time dedication daily for prep, trading, review | Improved focus, discipline, emotional control | Traders wanting professional and structured approach | Reduces impulsive trades, enhances focus, facilitates improvement |

| Choose the Right Trading Tools and Technology | Medium to high - setup cost and learning curve | Investment in hardware, software, data feeds | Faster execution, better info, competitive advantage | Traders requiring speed and multi-instrument tracking | Reduces slippage, improves analysis, speeds up trading process |

Putting It All Together: Your Path to Disciplined Trading

Navigating the fast-paced world of binary options trading requires more than just a passing interest; it demands discipline, strategy, and a commitment to continuous improvement. The journey to becoming a consistently profitable trader is built upon the foundational principles we have explored. These are not just isolated suggestions but a comprehensive framework for success.

The eight day trading tips outlined in this guide represent the pillars of a resilient trading career. From the unwavering structure of a trading plan to the non-negotiable rules of risk management, each element works in synergy. A sophisticated technical analysis strategy will quickly fail if not supported by the emotional fortitude to handle losses and avoid impulsive decisions. Likewise, the most advanced trading platform is only as effective as the trader using it.

Your Blueprint for Consistent Application

The true differentiator between a novice and a seasoned trader is not the discovery of a secret formula but the consistent application of proven principles. The path forward involves integrating these concepts into a cohesive daily routine.

- Embrace the Process: Shift your focus from chasing immediate profits to mastering flawless execution. A well-executed trade that results in a small loss is far more valuable than a lucky, undisciplined win.

- Review and Refine: Treat your trading journal as your most important tool. Regularly review your performance, identify patterns in your behavior, and make incremental adjustments to your strategy and emotional responses.

- Start Small, Prove It Small: Before scaling your capital, prove your strategy's edge with minimal risk. Consistency over a significant number of trades is the only true validation of your approach.

From Tips to Habits: The Ultimate Goal

Ultimately, these day trading tips must evolve from conscious efforts into subconscious habits. Your trading plan becomes your default guide, proper position sizing becomes second nature, and emotional control becomes an ingrained reflex. This transformation is where sustainable profitability is born. It is the result of treating trading as a professional business, not a hobby or a get-rich-quick scheme.

By internalizing these lessons, you are not just learning to place trades; you are building the skills, mindset, and discipline required to navigate market volatility and make objective, data-driven decisions. This disciplined approach is your greatest asset and the most reliable path toward achieving your long-term trading goals.

Ready to deepen your knowledge with expert reviews and advanced strategies? For unbiased broker comparisons, in-depth platform guides, and more essential day trading tips, visit BinaryOptionsGuide. We provide the critical resources you need to make informed decisions on your trading journey.

Ready to Start Trading?

Choose from our top-rated binary options brokers and start your trading journey today.

Start Trading Now →